Latest News

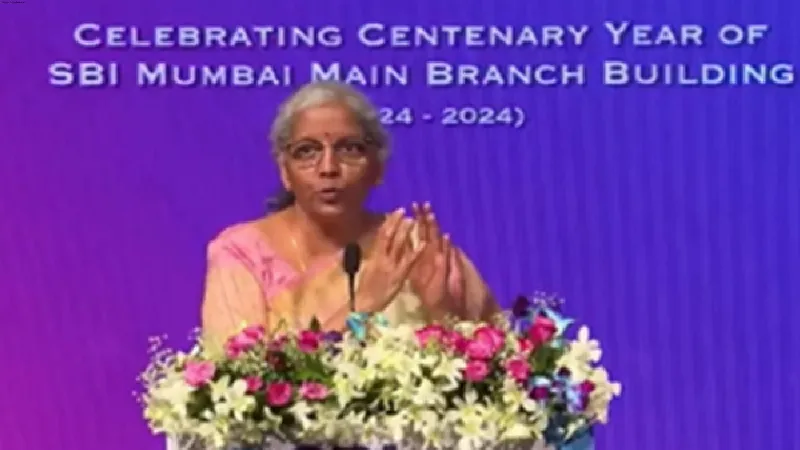

Modi govt committed to pursue ongoing reforms, with cutting-edge technology and transparency: Sitharaman

New Delhi: The government is committed to harnessing cutting-edge technology, enhancing transparency, and pursuing ongoing reforms to lay a strong foundation for a Viksit Bharat, said Union finance minister and BJP leader Nirmala Sitharaman, amidst the Lok Sabha polls.

In a long thread of posts on X, she said her government under Prime Minister Narendra Modi, after coming back to power, will continue to "maximize the value and impact" of hard-earned taxpayer money, ensuring it is put to the best possible use for the benefit of all.

She said in the posts that various expenditure reforms have helped save interest costs while building transparency and efficiency in treasury management.

The Union government administers 108 Centrally Sponsored Schemes (CSS) through State and UT governments, with a budget of approximately Rs 5.01 lakh crores for 2024-25 and Rs 4.76 lakh crores for 2023-24.

Further, she asserted that the last decade has witnessed a substantial improvement in the sanctity and credibility of the Union Budget, leaving past constraints and archaic practices behind.

"...Our government has reshaped the budget from a mere record of expenditures into a strategic blueprint for equitable development," said in her post.

The Budgets of the government are characterized by fiscal prudence, transparency, and inclusiveness, ensuring investments in social development and infrastructure, she noted.

"We make judicious and efficient use of every rupee collected from our taxpayers and give them a transparent picture of public finances. Various historic decisions and reforms have been taken by our government to strengthen and bring transparency to the Budgetary process and practices."

She mentioned about the advancement of the Budget cycle since 2017-18. The budget presentation day has been shifted to February 1 every year instead of the last working day in February. It effectively advanced the expenditure cycle by two months.

"Now, the entire budgetary exercise, including the legislative process, is completed well before the start of the financial year. This has improved administrative efficiency and delivery of schemes as Ministries have the full budget available from the beginning of the financial year - 1 April," she explained.

This has also empowered the State governments, which used to present the Budget earlier than the Centre. She said States are now able to plan their budgets better as they are now aware of details of the Centre's fiscal plan for the upcoming year.

"This reform helps the state governments plan their project financing, counterpart funding, implementation of central projects, and borrowing requirements well in advance."

The advancement of the budget cycle aided the synchronisation of financial outlays and expenditures between the Centre and the States. She also pointed out about the merger of the Rail Budget with the General Budget.

From 2017-18, the current government merged the Railway Budget with the Union Budget to bring the affairs of the Railways to centre stage.

"The number of Demands for Grants operated by Railways has been reduced from 16 to one, and appropriation for Railways is part of the main Appropriation Bill," she said, explaining the importance of the merger.

Explaining the transparency brought in by her government in Budget numbers, she said they have prioritized transparency in its budgeting practices and numbers.

"This starkly contrasts the Congress-led UPA government's repetitive practice of hiding the deficits through off-budget borrowings and issuance of 'Oil Bonds', which somewhat covertly shifted the fiscal burden to future generations," she said targeting the principal Opposition party.

Under UPA, she alleged that standard fiscal practices were routinely changed to make Budget numbers look favourable.

"Countries with transparent budgets are often viewed more favourably by international bodies such as the IMF and World Bank. This can lead to improved global trust," she added.

Despite the increase in food subsidy allocations after COVID-19, complete food subsidy is being provided transparently through the Government budget, she said, reiterating about the transparent budgeting. In 2020-21, the government repaid all outstanding loans provided to FCI in lieu of food subsidy by providing additional budgetary support.

Budget allocations of key infra-focussed ministries -- Road Transport and Highways and Railways -- have been significantly enhanced from 2022-23 and 2023-24, respectively, thereby reducing their dependence on market borrowings.

In her long thread of posts, she also touched upon the rationalisation of Supplementary Demand for Grants.

Usually, three Supplementary Demands for Grants were presented in Parliament during a financial year to seek additional appropriations or to make substantial reallocations within the appropriations already granted in the regular Budget.

From 2022-23, it was decided to limit the number of Supplementary Demands for Grants to two, now presented during Winter and Budget Sessions.

"This has made substantive improvements in the process of budget estimation and improved financial discipline," Sitharaman wrote.

On the Contingency Fund of India, a mechanism laid down by the Constitution to facilitate the Centre in meeting unforeseen expenditures that arise when the Parliament is not in Session, she said her government increased the corpus of the Contingency Fund to Rs 30,000 crore from Rs 500 crore with the approval of Parliament in 2021-22.

The corpus of this Fund, however, remained at Rs 500 crore from 2005-06 despite an exponential increase in the budget over the years.

"The problem of a low corpus was felt acutely during Covid-19 when the Parliament couldn't meet and conduct business," Sitharaman said.

Various expenditure reforms have helped save interest costs while building transparency and efficiency in Treasury management, which is critical as it reduces the wastage of the country's crucial resources. The minister said that it also ensures that every rupee collected from taxpayers is used with utmost efficiency.