G20: World Bank says impact of India’s digital public infrastructure goes beyond financial inclusion

New Delhi: World Bank has said India’s Digital Public Infrastructure has had a transformative impact, extending far beyond just financial inclusion. The international financial institution in a document applauded India, stating what the country has achieved in just six years would have otherwise taken about five decades.

India has developed some of the finest digital public goods infrastructure which could change lives the world over. UPI, Jan Dhan, Aadhar, ONDC, and CoWin are some of the examples.

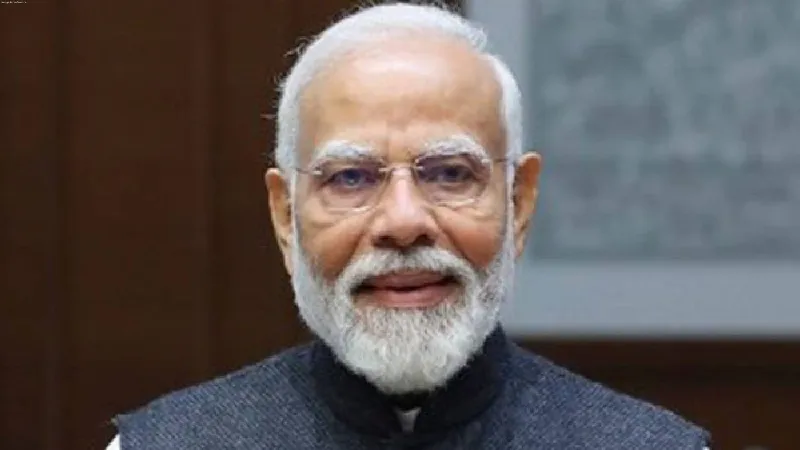

The World Bank document prepared ahead of the big G20 Summit in New Delhi highlighted the key measures taken by the Modi government and the pivotal role of government policy and regulation in shaping the Digital Public Infrastructure (DPI) landscape.

World Bank said JAM (Jan Dhan, Aadhar, Mobile) trinity – a combination of bank accounts for all, Aadhaar, and mobile connectivity -- has propelled financial inclusion rate from 25 per cent in 2008 to over 80 per cent of adults in past six years, a journey which according to it shortened by up to 47 years -- thanks to DPIs.

“While DPIs’ role in this leapfrogging is undoubtable, other ecosystem variables and policies that build on the availability of DPIs were critical. These included interventions to create a more enabling legal and regulatory framework, national policies to expand account ownership, and leveraging Aadhaar for identity verification,” the World Bank document noted.

Since its launch in 2014, the first year under Narendra Modi’s prime ministership, the number of PM Jan Dhan Yojana accounts tripled from 147.2 million in March 2015 to 462 million by June 2022; women own 56 percent of these accounts, more than 260 million.

The Pradhan Mantri Jan Dhan Yojana (PMJDY) – the national mission for financial inclusion and banking the unbanked - completed nine years of implementation. The initiative was announced by Prime Minister Narendra Modi in his maiden Independence Day address from Red Fort in 2014. Later he launched the programme on August 28, 2014.

PMJDY has brought the unbanked into the banking system, expanded the financial architecture of India and brought financial inclusion to almost every adult.

Further, the World Bank also noted how India leveraged technology to directly transfer benefits to the citizens, besides using UPI for retail payments.

“The DPI in India has also enhanced efficiency for private organizations through reductions in the complexity, the cost and the time taken for business operations in India,” it said.

Unified Payments Interface (UPI) is India’s mobile-based fast payment system, which facilitates customers to make round-the-clock payments instantly, using a Virtual Payment Address (VPA) created by the customer. UPI payment system has become hugely popular for retail digital payments in India, and its adoption is increasing at a rapid pace.

A key emphasis of the Indian government has been on ensuring that the benefits of UPI are not limited to India only, but other countries, too, benefit from it. So far, Sri Lanka, France, UAE, and Singapore have partnered with India on emerging fintech and payment solutions.