Latest News

Railway stocks soar on India-Europe economic corridor deal; IRFC hits 10% upper circuit

.png)

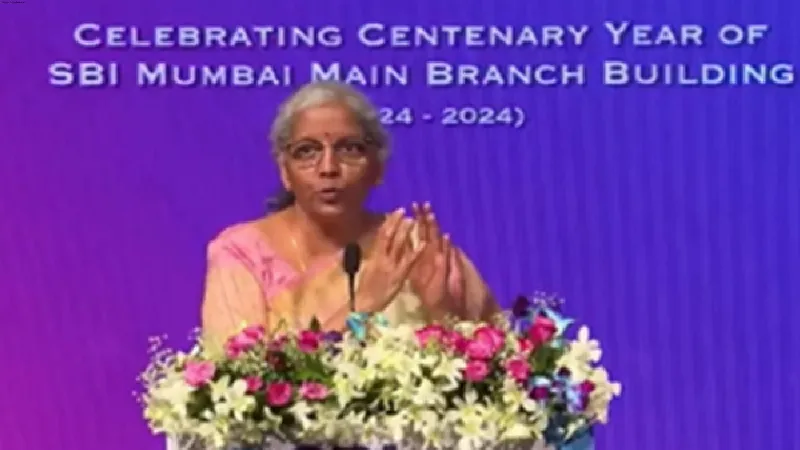

New Delhi: It is party time for investors who have put in their bets on shares of companies involved in railways and its allied activities.

An ambitious rail-port economic corridor deal to connect India-Middle East-Europe, seen as an alternate supply chain route in a completely evolved post-pandemic world order, was signed on the sidelines of the successful G20 Summit held in New Delhi -- thus putting focus on railway infrastructure.

Shares of Indian Railway Finance Corp, the dedicated funding arm of Indian Railways, have hit a 10 per cent upper circuit minutes after the opening bell on Monday. The upper circuit is the highest possible price that the stock of a firm can trade at on that particular day.

Besides IRFC, Rail Vikas Nigam, RITES, Railtel Corporation of India, and Titagarh Rail Systems were in the range of 3-9 higher at the time of writing this report.

Coming back to the deal, Saudi Arabia, the European Union, India, United Arab Emirates (UAE), France, Germany, Italy, and the US committed to work together to establish the India-Middle East-Europe Economic Corridor (IMEC).

The corridor is expected to stimulate economic development through enhanced connectivity and economic integration between Asia, the Arabian Gulf, and Europe.

The IMEC will comprise of two separate corridors, the east corridor connecting India to the Arabian Gulf and the northern corridor connecting the Arabian Gulf to Europe.

It will include a railway that, upon completion, will provide a reliable and cost-effective cross-border ship-to-rail transit network to supplement existing maritime and road transport routes – enabling goods and services to transit to, from, and between India, the UAE, Saudi Arabia, Jordan, Israel, and Europe.

Along the railway route, they intend to enable the laying of cable for electricity and digital connectivity, as well as pipe for clean hydrogen export.

Meanwhile, the broader Indian stock indices started Monday’s trade on a firm note, taking cues from the overall successful G20 Summit in New Delhi.

The consensus on the New Delhi declaration by all G20 member countries despite a divided house given the ongoing war in Ukraine and the West’s sanctions on Russia, the ambitious rail-port economic corridor deal to connect India-Middle East-Europe, and the launch of Global Biofuel Alliance on the summit sidelines seemed to have attracted investors to bet in the market.

Sensex and Nifty were 0.3-0.4 per cent higher from their Friday close of 66,861.16 points and 19,910.10 points, with all sectoral indices in the green. Last week, Indian stocks ended at a high to log their best week in over two months

Going ahead, August inflation data in India and the US, expected to be released on Tuesday and Wednesday are likely to be the next market trigger for fresh cues.

Retail inflation in India rose sharply in July to 7.44 per cent and in the process breached RBI's 6 per cent upper tolerance target, largely due to a sharp spurt in vegetable, fruit, and pulses prices.