Latest News

GST Council recommends decriminalising 3 offences, including tampering of evidence

New Delhi: The GST Council has recommended decriminalising three different types of offences, including the tampering of material evidence.

"A major path-breaking recommendation with regard to decriminalising certain offences,... three kinds of offences, were taken. They pertain to obstructing or preventing any officers in the discharge of his duties, deliberate tampering of material evidence, and failure to supply information," said Revenue Secretary Sanjay Malhotra at the post-GST Council press conference here on Saturday. The other major decision taken at the meeting was regarding the threshold limit of tax amount for launching prosecution on any criminal offence defined under the GST laws that has been increased from Rs 1 crore to Rs 2 crore, Malhotra told reporters.

This, however, would not be applicable to those offences such as fake invoicing.

Moreover, GST rates on pulses husk and knives have been reduced from 5 per cent to nil. GST on ethyl alcohol for the purpose of blending of ethanol has been exempted. Earlier, it was taxed at 18 per cent.

"Already we have allowed 5 per cent reduced rate for blending with petrol by oil marketing companies. Now this exemption is being extended to refineries as well. This will promote our efforts on blending and reduce our dependence on imported crude and thereby save precious foreign exchange," the secretary said.

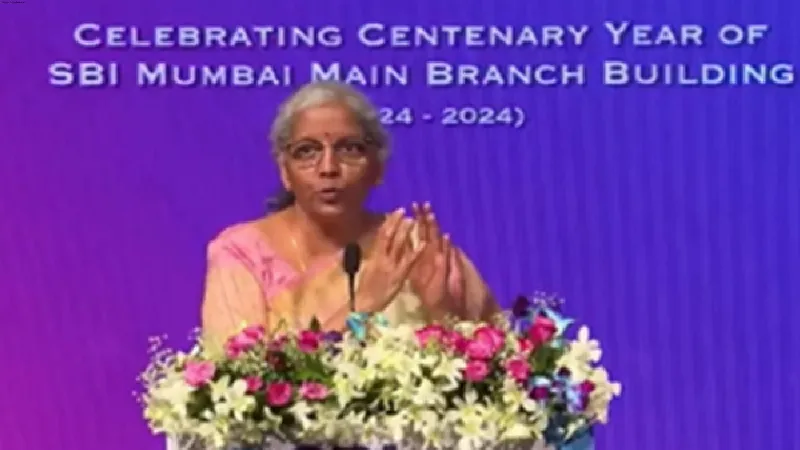

At the start of the press briefing, Union Finance Minister Nirmala Sitharaman, who is the chairperson of the Council, said as many as 15 items were on agenda during today's GST Council meeting, of which eight were completed, and the remaining will be carried forward to the next council meet. (ANI)

The 47th meeting was held in June 2022, in Chandigarh. (ANI)