Latest News

A RELIEF RALLY LIKELY FOR EQUITY MARKETS POST BUDGET

Situation like fog on the roads due to severe cold in North India in the month of January is also visible in the Indian stock market at present. Last week, the stock market took a dive and the future situation became murky again. Now it is believed that the interim budget of the Modi government to be presented in the Parliament on February 1 will clear the situation about the market and the stock market will start looking ahead before the Lok Sabha elections.

Due to the rise in crude oil prices, continuous selling by foreign institutional investors, two days of holidays in the last week, monthly cutting of the futures market and relatively weak performance of various companies, the stock market could not return to its upbeat journey and ‘mandadiyas’ dominated in the market, due to which the markets closed with weakness for the second consecutive week.

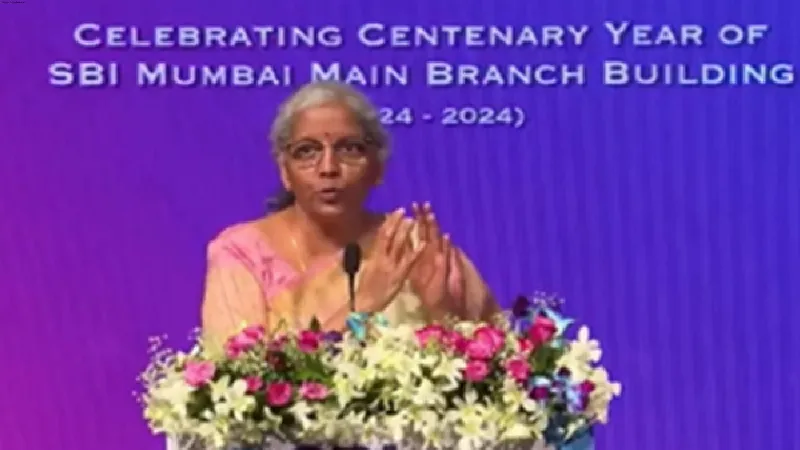

Now it is expected that in the interim budget coming before the elections, Union Finance Minister Nirmala Sitharaman will increase the profit limit on long-term investments, encouraging investors and suggesting measures for their protection, besides giving a boost to the economy. She will make announcements, which will give a new dose of momentum to this market and the journey of improvement will start once again.

There is still a lot of time left for the LS polls, but the atmosphere created in the country due to the consecration of Ram Temple on January 22 and the political turmoil currently taking place in Bihar, the joint opposition alliance is certain to collapse. On the basis of this, it can be said that the present BJP government at the Centre does not see any major threat.

The only thing that matters is how many MPs of BJP and its allies reach the Lok Sabha and what is the reaction of the stock market after the results.

Indian stock markets have been falling for the second consecutive week. According to the data, last week there was a decline of 722.98 points i.e. about 1%; BSE index closed at 70700.67 points, while the NSE index also declined by 219.20 points i.e. about 1% and the NSE Nifty index closed at 21352.60 points.

The special thing is that while there has been a decline of about one percent in basic index, there has been a slight improvement in the midcap and smallcap indices, whichindicates that the index may be weak in market, but not in the shares.

The latest fall in the market can be attributed to Foreign Institutional Investors (FIIs), who sold Rs 12194.38 cr last week, while Domestic Institutional Investors (DIIs) responded to this selling by buying Rs 9701.96 cr.

Talking about the bullion market, there was a slight improvement in the prices of gold and silver this week and gold rose by Rs 100 per ten grams to Rs 64,100 and silver rose by Rs 300 per kg to Rs 73,300 per kg. Due to the demand in view of marriages, traders are currently assessing the general ups and downs in the bullion business.

The traders say that there are more chances of a rise in the market. The government wants to see the market grow, but the impact of Interim Budget announcements will be more technical.

(This is the personal opinion of the author. The author, his family members and acquaintances may have investments in the companies mentioned in the article.)

Vimal Kothari Associate Editor, First India News & Senior Journalist